WeChat Pay (or Weixin Pay), the popular mobile payment service operated by Chinese tech giant Tencent, plans to allow users to link their accounts to foreign bank cards by mid-July, a move that could ease the difficulties faced by foreigners living and traveling in China who want to pay with cash.

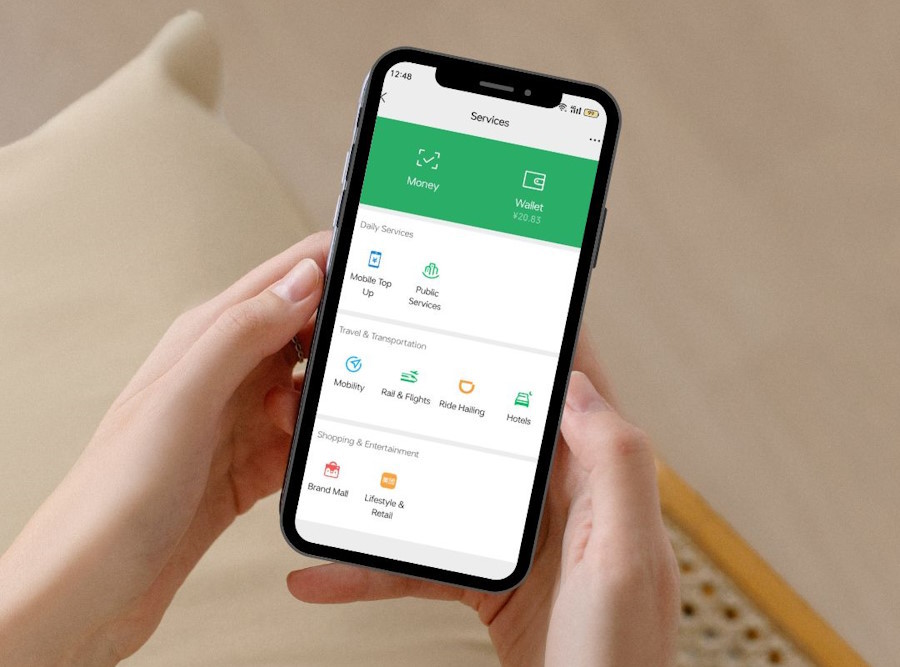

According to a statement released by Tencent on Monday, WeChat Pay will support the binding of Visa, Mastercard, American Express, Discover and JCB cards issued outside mainland China. Users will be able to scan QR codes at merchants that accept WeChat Pay, as well as transfer money to other users.

The announcement comes as China is gradually reopening its borders to foreign visitors after months of strict travel restrictions due to the Covid-19 pandemic. However, many foreigners still encounter challenges when trying to pay for goods and services in China, where cash is increasingly being replaced by digital payments.

WeChat Pay and its rival Alipay, owned by Alibaba Group, dominate the mobile payment market in China, with a combined share of more than 90%. Both platforms require users to link their accounts to a Chinese bank card, which can be difficult to obtain for foreigners who need to provide various documents and meet certain criteria.

Some foreigners resort to using cash, which is often rejected by merchants who prefer digital payments, or asking their Chinese friends to pay on their behalf and then reimbursing them. Others use third-party services that allow them to link their foreign bank cards to WeChat Pay or Alipay, but these services may charge fees or have limited functionality.

The new feature of WeChat Pay could make it easier for foreigners to access the convenience and benefits of digital payments in China, such as discounts, rewards and integration with other online services. It could also help Tencent expand its user base and revenue from overseas markets, as well as attract more merchants to accept WeChat Pay.

However, some challenges and uncertainties remain. For instance, it is unclear how the exchange rate and transaction fees will be determined and whether there will be any limits on the amount or frequency of payments. Moreover, some users may have concerns about the security and privacy of their data, especially in light of the recent tensions between China and some Western countries over issues such as cybersecurity and human rights.

Comments